Welcome To GeM Pro Consult

Hire us for Handling your GeM Portal on Monthly Basis!

Unlock growth with us! Our expert GeM services save you time and money while ensuring full transparency, Gem ID security, and company privacy.

We Are The Trust Of:

GeM Registration

Who Can Register on GeM as a Vendor/Service Provider?

In accordance with General Financial Regulation (GFR) 149 of the Government of India, all central government ministries, public sector companies, and states/UTs under MoUs with GeM are mandated to procure general goods and services exclusively through the GeM portal, facilitated by seller registration.

GeM extends its platform to various legal entities across India, facilitating registration for:

- Sole Proprietorship: Embracing both unlisted organizations and individual consulting providers, ensuring equitable access.

- Partnership Firms: Welcoming all registered partnership firms, fostering collaboration in the procurement ecosystem.

- Companies: Embracing both Pvt. Ltd. and Public Ltd. listed companies, promoting inclusivity and diversity in procurement.

- Trust/Society: Encouraging registered entities selling goods/services to contribute to the procurement landscape.

- PSU: Engaging public sector companies supplying goods/services to government entities, ensuring comprehensive participation.

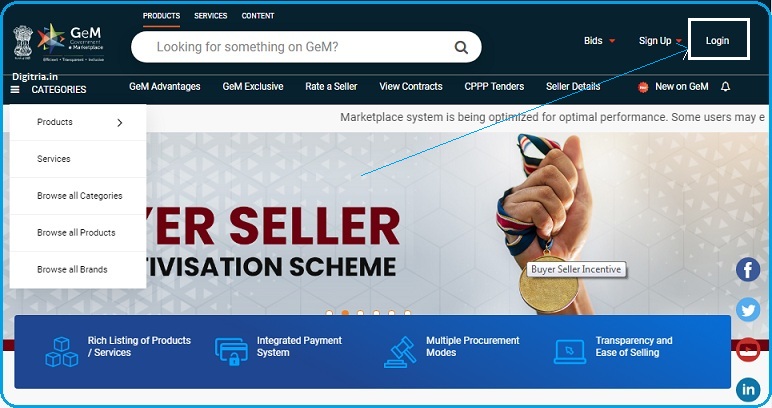

What is GeM Portal?

The GeM portal, short for Government e-Marketplace, is an online platform launched by the Government of India to facilitate procurement of goods and services by various government departments, organizations, and public sector undertakings (PSUs). GeM serves as a centralized marketplace where government buyers can purchase a wide range of products and services from registered sellers/vendors, including both government agencies and private businesses.

Documents Required for Proprietorship Firm

- PAN No: PAN No of owner of the Organisation

- Location Details: Details of – Registered Office, Billing Address, Factory, Warehouse, other Office Premises

- IT Return: At least latest IT return and minimum 2 to 3 years IT return details should be submitted

- Bank Details: Bank Details of the entity to be entered. Please note: In case if more than one bank details are provided then only one of the them will be considered as a Primary Bank

Documents Required for Partnership Firm

- PAN No: Firm PAN No

- CIN No:CIN No of Registered Firms

- Key Person Validation:Normally Person who filed the IT Return should be registered as a Primary User. Based on directors’ detail obtained from CIN validation this key person validation can be done

- Location Details: Details of – Registered Office, Billing Address, Factory, Warehouse, other Office Premises

- IT Return: At least latest IT return and minimum 2 to 3 years IT return details should be submitted

- Bank Details: Bank Details of the entity to be entered. Please note: In case if more than one bank details are provided then only one of the them will be considered as a Primary Bank

Documents Required for Companies

- PAN No: Company PAN No

- CIN No:Company CIN No

- Key Person Validation:Normally Person who filed the IT Return should be registered as a Primary User. Based on directors’ detail obtained from CIN validation this key person validation can be done

- Location Details: Details of – Registered Office, Billing Address, Factory, Warehouse, other Office Premises

- IT Return: At least latest IT return and minimum 2 to 3 years IT return details should be submitted

- Bank Details: Bank Details of the entity to be entered. Please note: In case if more than one bank details are provided then only one of the them will be considered as a Primary Bank

Documents Required for Trust/ Society/ Association of person

- PAN No: Organisation PAN No

- CIN No:Registered number of the Organisation

- Key Person Validation:Normally Person who filed the IT Return should be registered as a Primary User. Based on directors’ detail obtained from CIN validation this key person validation can be done

- Location Details: Details of – Registered Office, Billing Address, Factory, Warehouse, other Office Premises

- IT Return: At least latest IT return and minimum 2 to 3 years IT return details should be submitted

- Bank Details: Bank Details of the entity to be entered. Please note: In case if more than one bank details are provided then only one of the them will be considered as a Primary Bank

Documents Required for Goverment Entities

- PAN No: Organisation PAN No

- CIN No:Registered number of the Organisation

- Key Person Validation:Normally Person who filed the IT Return should be registered as a Primary User. Based on directors’ detail obtained from CIN validation this key person validation can be done

- Location Details: Details of – Registered Office, Billing Address, Factory, Warehouse, other Office Premises

- IT Return: At least latest IT return and minimum 2 to 3 years IT return details should be submitted

- Bank Details: Bank Details of the entity to be entered. Please note: In case if more than one bank details are provided then only one of the them will be considered as a Primary Bank

Benefits for Sellers by Registering on GeM Portal

Unlock a host of advantages by joining GeM as a seller, including:

- Access to the entire National Public Procurement Market, opening doors to vast opportunities.

- Special Provisions for Start-ups & MSMEs, promoting entrepreneurship and fostering growth.

- Fully online, paperless, and contactless platform, ensuring efficiency and convenience in procurement.

- Simplified brand application and approval process, reducing administrative burden and promoting brand visibility.

- Multiple invoices for Single Order, streamlining financial transactions and enhancing ease of doing business.

- Online grievance redressal mechanism, providing a robust platform for dispute resolution and ensuring fairness in transactions.